Titanium dioxide prices in China have risen 5% since

February, but there is no disguising the fact that downstream demand is low and

showing few signs of improvement. Everything is pointing towards TiO2 prices

resuming their downwards trajectory sooner rather than later…

For real-time intelligence on China’s TiO2 market, try

E-Journal. You can access E-Journal free for two months by registering here: http://www.cnchemicals.com/Special/SPFreeTrial.aspx

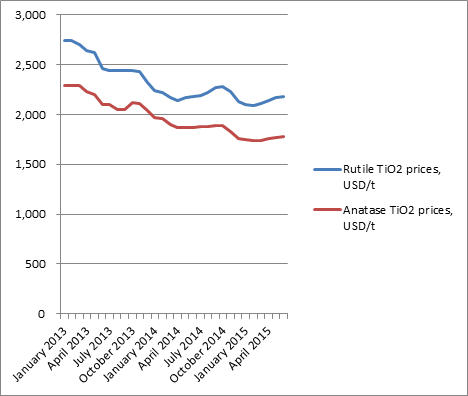

Figure 1: TiO2 prices in

China, January 2013-June 2015 (Source: CCM)

If you looked purely at price data, you would assume that

conditions in China’s TiO2 market had improved markedly in 2015. Prices of both

rutile and anatase TiO2 have been rising steadily since March, with rutile TiO2

prices increasing 4.8% between late February and June 1, while anatase TiO2

prices rose 6.0% over the same period, according to data from CCM’s price

monitoring service.

Why

TiO2 prices have been rising in China

However, this recovery in prices is a little misleading.

Rather than being a result of increasing demand, it has instead mainly been

fuelled by a slowdown in production and the opportunism of some producers.

On the one hand, many small- and medium-sized producers

slowed down or suspended production when prices dipped to historical lows in

late 2014/early 2015. This was especially common in Guizhou, where there is a

large concentration of anatase TiO2 producers, and Sichuan, where fierce

competition tends to push prices extremely low. As a result, suppliers gained a

bit more power over prices despite there being no noticeable uptick in demand.

And, desperate to increase profit margins, suppliers have

seized on any opportunity to raise prices in recent months. The end of the

Spring Festival holidays and the merger of Lomon and Henan Billions have

provided two such convenient opportunities.

A

false dawn

However, these price rises are unlikely to be sustainable.

Several Chinese distributors have confessed to CCM in recent weeks that they

are unable to raise TiO2 prices any further when negotiating with downstream

companies, which indicates that China is still very much a buyer’s market.

What’s more, there is scant sign of an upturn in demand from

the three major downstream industries of TiO2 in China:

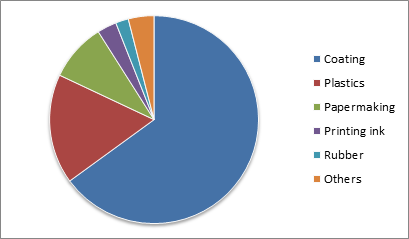

Figure 2: Downstream

markets of TiO2 in China by consumption volume, 2014 (Source: CCM)

Coatings

Though the introduction of a much tougher new Environmental

Protection Law and a new 4% excise on coatings with a high VOC content has

helped eliminate some outdated capacity, there is still severe overcapacity in

China’s coatings industry. Many coatings companies are struggling to turn a

profit, and as a result they are putting TiO2 suppliers under pressure to lower

prices.

And the gloomy statistics coming out of China’s National

Bureau of Statistics (NBS) suggest that there is little chance of this

situation changing in the near future. China’s output of coatings in April was

down 5% year on year, mainly due to the slowdown in the real estate market –

the total area of new housing projects under construction during January-April

was down 17% on last year.

The pain being felt by coatings companies is being passed on

to the TiO2 industry directly. In Panzhihua, Sichuan (an area with a high

concentration of TiO2 companies), for example, TiO2 production fell over 15%

between March and April, according to data from NBS. With demand so sluggish,

there is going to be more downward pressure on prices during the second half of

the year.

Plastics

Until recently, the rebound in global oil prices was

actually fuelling a strong recovery in plastics prices in China. In April, the

prices polythene (PE), polypropylene (PP) and several other plastics had grown

significantly from their low point in January.

However, encouraged by the rising prices, several domestic

plastics manufacturers resumed production in May, tipping the supply-demand

balance back towards oversupply. This sent plastics prices plummeting once

more. By June 1, PE prices were down over 6% month on month and PP prices had

fallen almost 9%.

The plastics market is strongly influenced by oil prices, so

there is a chance that a sudden rise in global oil prices will breathe new life

into the market. However, at the moment the plastics market is not looking like

a likely source of strong demand for TiO2.

Papermaking

Conditions are even worse in China’s papermaking industry,

where manufacturers are struggling with high production costs, high inventories

and a host of other problems. According to sources in the industry, sales have

been poor this year even during March and April, which is traditionally the

season when demand is strongest.

The summer is usually a difficult period for paper

manufacturers in China, so demand for TiO2 is likely to be even lower during

this period.

With market conditions in China so poor, domestic TiO2 prices

are likely to remain flat at best during the next quarter, and a fall in prices

would not be a surprise.

For

more information about CCM and our coverage of China’s TiO2 market, please

visit www.cnchemicals.com or

get in touch with us directly by emailing econtact@cnchemicals.com or

calling +86-20-37616606.